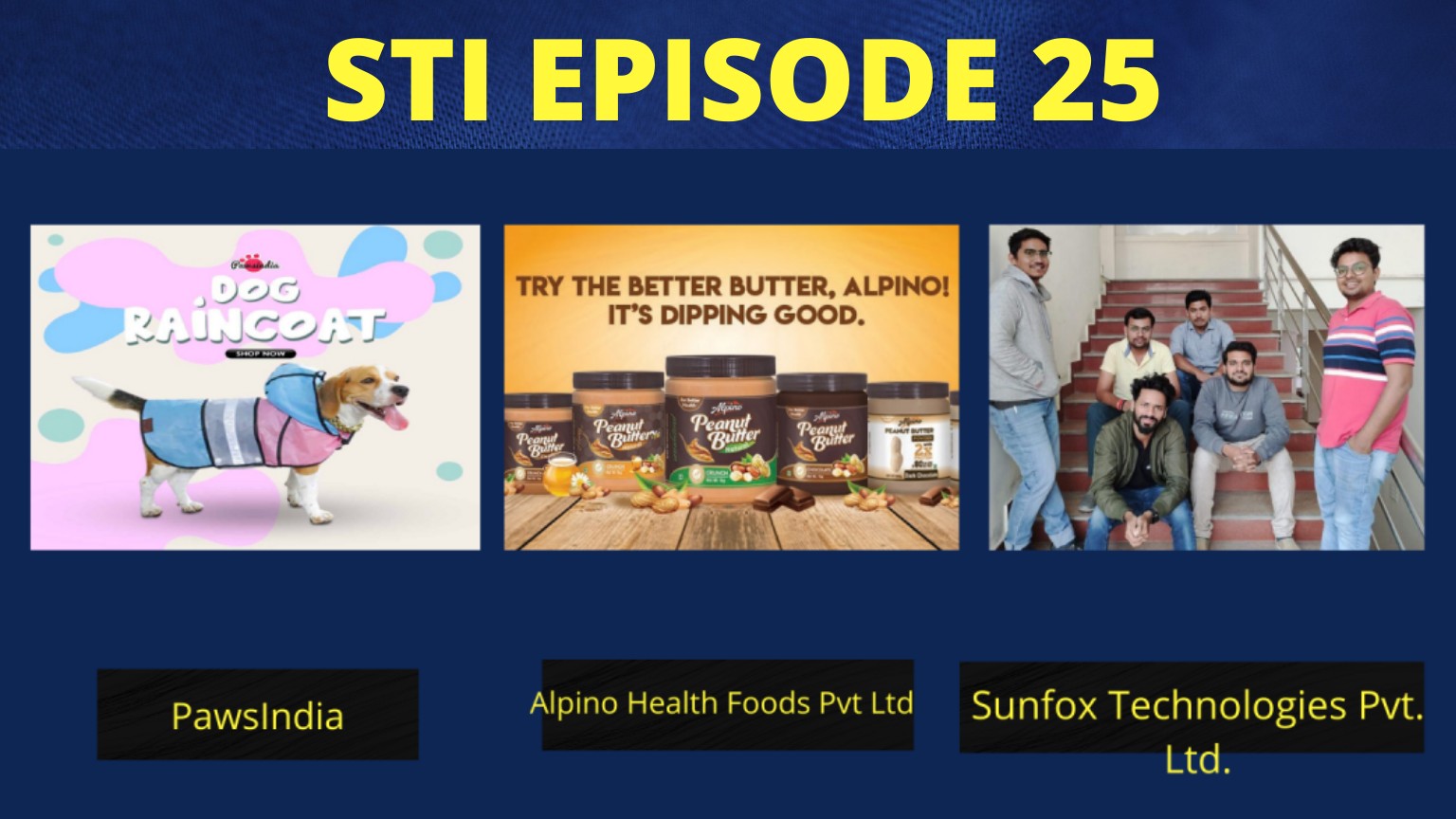

This is shark tank India episode number 24. In this episode of shark tank India PawsIndia- an all round marketplace for all your pets needs, Spandan- a pocketable ECG device and Alpino Health Foods Pvt Ltd- all-natural peanut butter brand based in India are the pitches.

1. PawsIndia

- Owners: Priyam Singh and her Brother

She is from a pause area and lives in Bombay.Her elder brother is her co-owner.She is from the family of pharmaceutical business background.She worked in JP Morgan in the investment sector. Her brother is a B.Com and has worked in their business for 5 years.

-

About Pawsindia

Pawsindia is an ecommerce marketplace for pets and also a pet product development company which focuses on Innovation, advanced healthcare and product development.This company helps other start-ups to grow. PawsIndia is for the pets and always looks forward to the development of pets. Their e-commerce website has around 250-300 various products for pets.They are in manufacturing and developing pet products. The company has introduced the first smart toy for pets which can be operated with a remote. The sales in healthcare is around 25% whereas 65% is from food and toys.

-

Pawsindia Gross Profit and Sales

The company’s valuation is 12.5 crores rupees. When the company became on-board because of their unique service many small companies came to raise the funds for PawsIndia. 90% revenue is generated from their own venture and remaining 10% is from other investors. The sales generated in the last month was 20 lakhs rupees and the net profit is around 15-16%.In the FY21-22 they have generated a revenue of 1.20 crore rupees and in the FY20-21 it was around 1.20 crore rupees.The company has projected a sales of Rs3 crore in the FY 21-22.Among their SKUs, the hemp oil is the bestseller, smart bone is also popular among urban people.

-

Asks by the Pitchers of Pawsindia

Pitchers approach with a ask of 50 lakhs for 4% equity of the company.

-

Counter offers for Pawsindia

Namita Thapar stepped out of the deal. Vineeta Singh advised to specialise in a particular product field and stepped out. Peyush also stepped back from the deal. Ghazal said that she has already invested in such a company and for conflicts she is out.

However,Anupam Mittal was interested and gave some conditions for the deal:

- Meeting with co-founder.

- Change in strategy.

Anupam counter offers 50 lakhs rupees in exchange for 15% equity in the company. Pitchers ask whether there is any PO(Purchase order) Anupam will invest or not and Anupam told her that he will charge interest @12%.

-

Final Offer for Pawsindia

The final deal was done by Anupam for 50 lakhs rupees in exchange for 15% equity in the company at valuation of 3.33 crore rupees.

Checkout: Shark Tank India Controversy | Indian Mentality | Season 1

2. Sunfox Technologies Pvt. Ltd.

- Owners: Rajat Jain, Nitin Chandola, Sabit Rawat, Saurabh Badola. They have come from Uttarakhand.

-

About Sunfox Technologies Pvt. Ltd.

In India around 20lakhs people are dying out of heart attack every year and till date 1 person out of 4 people are dying out of heart attack. The main reason is not getting the right treatment at the right time. So the device Spandan was born which is a pocket size ECG device which can be used by anyone anywhere and it is compatible with smartphones. The machine provides the result with 99.7% accuracy. In covid time they have saved many lives by early diagnosis. They want to take their company to a global level. The company was started in the year 2106 in Dehradun.Journey was not so smooth as they needed resources to develop the product. The device is operated without batteries, any radiation and without a single switch.

-

Sunfox Technologies Pvt. Ltd. Gross Profit and Sales

The company’s valuation is 50 crores rupees. They showed the demo of the product. Spandan is available on Amazon and e-med platforms like 1mg.They have their own website.In the financial year of 2020-21 the sales was 1.20 crore rupees.Their online monthly sale is Rs.5 lakhs rupees. The Selling price is Rs.8000. They have raised funds from the Department Of Science and Technology, Government of India.They have also raised 3.5 crore rupees from private investments.CEO has 36% equity share, CFO has 34% equity share, the tech team has 10% equity share and rest of the 20% equity belongs to investors.

-

Asks by the Pitchers of Sunfox Technologies Pvt. Ltd.

Pitchers approach with a ask of 1cr ore rupees for 2 2 % equity of the company.

-

Counter Offers for Sunfox Technologies Pvt. Ltd.

All the sharks jointly counter offer 1 crore in exchange of 6% equity of the company.

-

Final Offer for Sunfox Technologies Pvt. Ltd.

This was an all-sharks deal and deal was finalised for 1 crore in exchange for 6% equity in the company.

Read: All About Seven Shark Tank India Judges | Net Worth,Investments

3. Alpino Health Foods Pvt Ltd

- Owners: Mahatva Vinodbhai Sheta, Gajera Umesh Prakashbhai, Priyank Babubhai Vora, Kanani Chetan Arvindbhai are all co founders from Gujrat. They are a team of six people. They have been together since college.

-

About Alpino Health Foods Pvt Ltd

Alpino is known for reaching healthy foods to people. Peanuts are one of the healthiest snacks in india. During their college days,the idea of this business struck them. Most of the peanut butter is exported outside india. They saw this as an opportunity and launched the made in india peanut butter brand Alpino. Also they have launched other healthy foods like muesli, apple cider vinegar,green tea and India’s first peanut butter powder. Currently, they are available on more than 15 online platforms and more than 3k offline stores.

Their main vision is to revolutionise the health food segment of india. They started in 2016 with 6 people and now working with a professional team of more than 60 people. They have four flavours that are natural, chocolate, classic and coconut with two variants crunchy and smooth. At Amazon they have more than 15 k reviews of the same product.

-

Alpino Health Foods Pvt Ltd Gross Profit and Sales

The company’s valuation is 75 cr . They have generated more than 35 cr revenue in the last 3 yrs. Their last year sales were 15 cr. This year till now they did sales of 13cr and will exit this year at 22 cr. The gross margin is 38%. Currently they have no net profit. One kg pack costs ₹449-500 out of which making cost is ₹150,gross profit is ₹92 and distributor’s margin is ₹258. Their online sales constitute 38% gross margin.

-

Asks by the Pitchers Alpino Health Foods Pvt Ltd

Pitchers approach with a ask of 1.5 cr for 2% equity of the company

-

Counter Offers Alpino Health Foods Pvt Ltd

Vineeta and Namita gave an offer of 1.5 cr for 10% equity. Anupam and Peyush give a counter offer of 1.5cr for 9% equity. Again Vineeta and Namita Thapar gave a counter offer of 1.5 cr for 8.5% equity. Again all four sharks Anupam, Peyush, Namita and Vineeta gave a counter offer of 1.5cr for 8% equity. The owners give a counter offer of 1.5 cr for 3 % equity. Again The owners countered their offer of 1.5 cr for 5% equity.

-

Final Offer for Alpino Health Foods Pvt Ltd

As the owners could not accept the offer, so no final deal was done.

-

Shark Lesson of the Say

Shark Vineeta Singh gave a lesson on product market fit. When you achieve the product market fit of your product, demand for the product increases and one cannot keep the stock. Unless you get an intuitive feeling that without any marketing product that has huge demand, don’t spend money on marketing. Because with marketing one can grow business, but creating genuine demand is important for large scalability of business.

View this post on Instagram